WiseCryptoNews has unveiled its platform built to track the most important developments across digital assets, offering readers a clearer view of shifting sentiment in real time. With the The XRP ETF approval debate heating up, the need for sharper insight into how crypto markets, narratives, and regulation cannot be over emphasized.

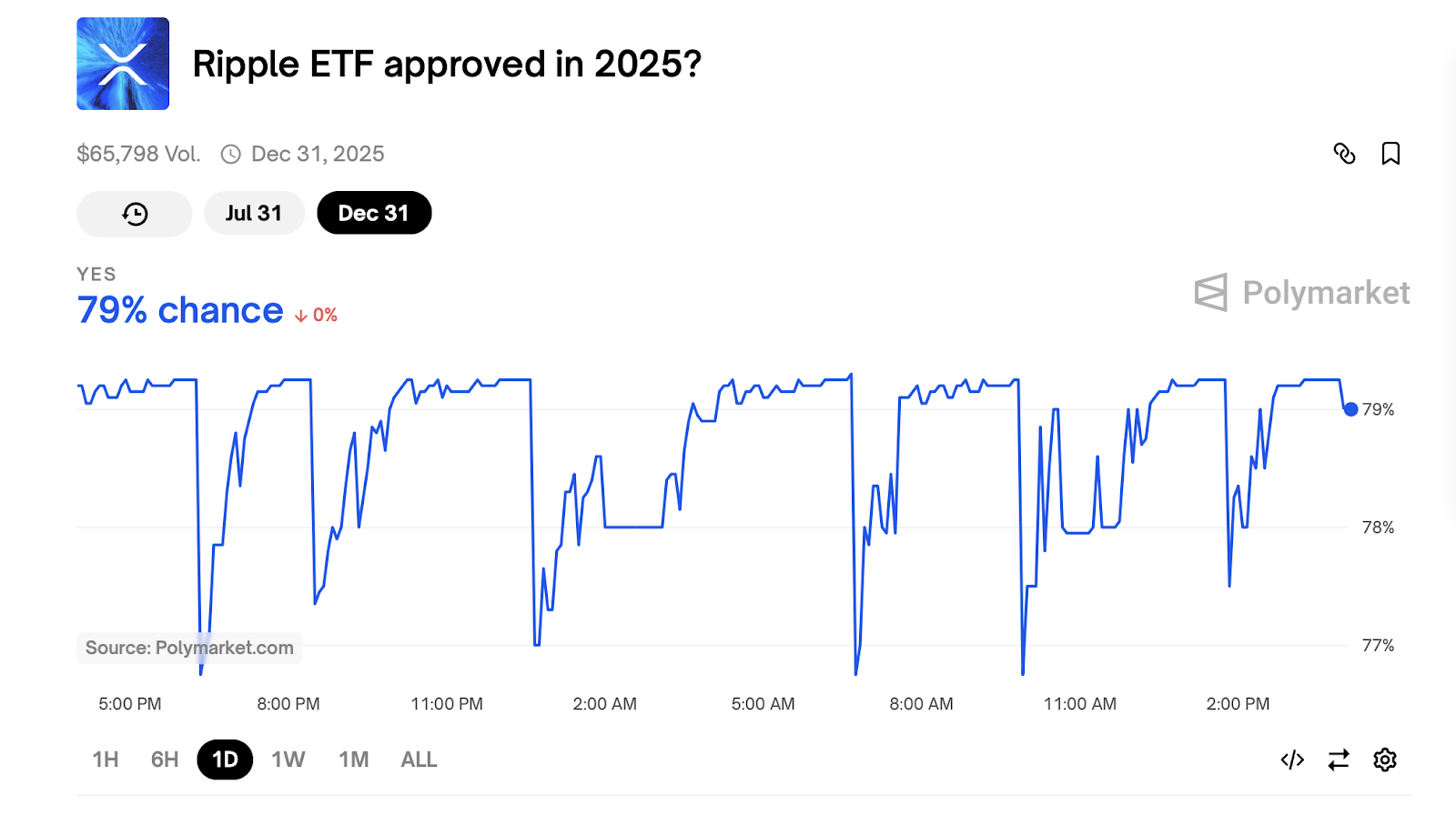

Case in point: decentralized prediction platform Polymarket now puts the odds of a spot XRP ETF gaining SEC approval by the end of 2025 at 79%, up from 65% just a few weeks ago. The jump reflects growing optimism in the asset’s regulatory outlook and renewed momentum across the broader altcoin ETF conversation.

XRP ETF Approval Odds Jump to 79% as Market Confidence Grows

Polymarket’s data shows this confidence hasn’t wavered much recently. Over the last 24 hours, the forecast has stayed in a tight range between 77% and 79%, suggesting that market participants see a real possibility of the XRP ETF becoming a reality before the year is out. This optimism is part of a broader trend in 2025, where interest in altcoin ETFs is climbing alongside improvements in regulatory clarity.

XRP ETF approval odds. Source: Polymarket

One major factor fueling this momentum is the developing relationship between Ripple Labs and the US Securities and Exchange Commission (SEC). In March 2025, the SEC officially dropped its longstanding lawsuit against Ripple, removing a major legal overhang that had clouded XRP’s future for years. With that out of the way, attention has shifted to the potential launch of a regulated XRP ETF — a move that would allow both institutional and retail investors to gain exposure to XRP through traditional financial markets.

While a spot XRP ETF hasn’t been approved yet, there has been significant movement on the futures side. The SEC recently signed off on three XRP futures-based ETFs from ProShares: the Ultra XRP ETF (2x leverage), Short XRP ETF (-1x leverage), and Ultra Short XRP ETF (-2x leverage). However, despite initial reports of an April 30 launch, ProShares clarified there was no ETF rollout on that date. The firm has since filed an update proposing May 14, as the new target — though this remains tentative and dependent on final SEC approval.

It’s important to note that futures-based ETFs don’t offer direct exposure to XRP itself. Instead, they track price movements through contracts, which can be useful for short-term speculation but lack the direct market linkage that spot ETFs provide. A spot XRP ETF would hold the underlying asset, offering a clearer and potentially less volatile route for long-term investors.

Several major asset managers, including Franklin Templeton, Grayscale, 21Shares, Bitwise, and WisdomTree, have pending applications for spot XRP ETFs. The SEC recently delayed its decision on Franklin Templeton’s application to June 17, a procedural move that analysts say is common and not necessarily a sign of rejection.

As interest builds, analysts are weighing in on what an XRP ETF could mean for the market. Standard Chartered has projected that a US-based XRP ETF could attract as much as $8.3 billion in inflows, potentially driving XRP’s price to $8 by 2026.

“Of the US spot ETFs approved so far, NAV as a percentage of market cap is 3% for Ethereum and just under 6% for Bitcoin. At current XRP market cap, that would imply a range of $4.4 billion to $8.3 billion as a future total NAV measure for an XRP ETF, which seems like a reasonable target range for inflows in the first 12 months,” Standard Chartered’s head of digital assets research Geoff Kendrick said.

On the other hand, analysts at Bitfinex are more cautious, suggesting that while an XRP ETF would be a major step, inflows might not match those seen with Bitcoin ETFs due to broader investor preferences.

At the time of writing, XRP is trading around $2.20, with a 24-hour trading volume of $2.14 billion. Though the token’s price has dipped slightly in the last day, the market remains focused on regulatory cues. The SEC’s next closed meeting is set for May 8, and speculation is mounting that further updates on Ripple or the XRP ETF applications could emerge from it.

All signs point to a shifting landscape for crypto ETFs in the US. While the final word on a spot XRP ETF is still pending, the odds — both in the market and among analysts — continue to move in its favor.