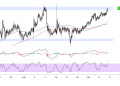

Tron is demonstrating resilience at a key ascending trendline that has underpinned the cryptocurrency’s impressive rally over the past month, with TRX/USD currently consolidating around $0.31708 after successfully defending this crucial technical floor.

The upward-sloping support line has proven its mettle on multiple occasions, suggesting that bulls remain committed to the longer-term bullish narrative despite recent profit-taking near the highs.

The ascending trendline represents the backbone of Tron’s recent advance, connecting a series of higher lows that have formed since late June. Each successful test of this rising support has coincided with renewed buying interest, creating a pattern of accumulation that has propelled the cryptocurrency from the $0.260 area to current levels.

The most recent bounce from this trendline appears to be gathering momentum, with price action showing signs of stabilization after the brief correction from the peak near $0.34. Fibonacci extension levels provide a roadmap for potential upside targets should the trendline support continue to hold and facilitate another leg higher.

The immediate resistance zone sits at the 38.2% extension around $0.322, followed by the more significant 50% level at $0.327. Beyond these initial hurdles, the 61.8% extension near $0.331 represents a natural profit-taking area, while the full 100% extension at $0.347 coincides with the recent swing high at $0.34 that marked the peak of the previous rally phase.

Moving Average Structure

The exponential moving average configuration continues to paint a constructive picture for Tron’s medium-term prospects. Both key moving averages are sloping higher and providing layered support beneath the current price action, with the shorter-term average acting as dynamic support just above the ascending trendline.

In addition, the expanding gap between the moving averages reflects the strength of the underlying uptrend, with momentum indicators suggesting that the recent pullback may have been a healthy correction rather than a trend reversal.

The fact that price has remained above both moving averages throughout the recent consolidation period indicates that institutional and retail participants continue to view dips as attractive accumulation opportunities.

Further Tron Upside

The stochastic oscillator has retreated from extreme overbought territory and is now positioned in neutral ground, providing ample room for another upward swing without immediately triggering overbought conditions. This reset in momentum conditions is often a prerequisite for sustained advances, as it allows the oscillator to climb higher while supporting price appreciation.

MACD momentum appears to be stabilizing after showing some weakness during the recent correction phase. The histogram bars have contracted significantly, indicating that selling pressure is waning. A potential bullish divergence may be forming as price makes higher lows while the MACD shows signs of bottoming, which could provide early warning of renewed bullish momentum.

The technical landscape suggests that Tron is well-positioned for another advance toward the Fibonacci extension targets, provided the ascending trendline support continues to attract buyers and fundamental catalysts emerge to reignite investor interest in the cryptocurrency’s ecosystem developments.