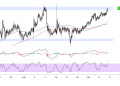

Tron (TRX/USD) continues to demonstrate impressive strength within its well-established ascending channel, currently trading at $0.32697 after a sustained advance from the $0.26000 lows.

The cryptocurrency appears to be setting up for another healthy pullback to key Fibonacci retracement levels, which could provide attractive entry opportunities for traders looking to capitalize on the ongoing uptrend.

Price action reveals a textbook example of a trending market, with Tron respecting both the ascending support and resistance lines that have guided its trajectory over recent months. The recent consolidation near current levels suggests that the market is gathering momentum for the next directional move, with the technical setup favoring another leg higher once any corrective phase concludes.

In addition, the ascending trend line that connects the swing lows has acted as dynamic support multiple times, reinforcing the bullish market structure and providing confidence that any pullback is likely to be temporary in nature.

Tron Retracement Zones

The Fibonacci retracement tool highlights several critical levels that could serve as support during any corrective phase. The 38.2% retracement level at $0.33152 sits just above current prices and could provide initial resistance in the event of a minor bounce before the pullback begins.

More significant support is likely to emerge at the 50% Fibonacci level around $0.32559, which often acts as a magnet for price during healthy corrections in trending markets. This level also roughly aligns with previous consolidation areas, adding confluence to its potential effectiveness as a support zone.

The deepest retracement that would still maintain the bullish character of the trend lies at the 61.8% Fibonacci level near $0.31969. This golden ratio retracement often represents the maximum pullback that trending markets experience before resuming their primary direction, making it a critical level for bulls to defend.

Should Tron experience a pullback to any of these Fibonacci levels, it would create an opportunity for the uptrend to gather fresh momentum for another assault on the channel’s upper boundary near $0.35070.

Continued Trend Strength

The moving average structure remains decidedly bullish, with both shorter and longer-term averages sloping upward and price trading comfortably above these dynamic support levels. The expanding gap between these indicators suggests that bullish momentum continues to build, supporting the case for higher prices ahead.

The stochastic oscillator has pulled back from overbought territory but remains in the upper half of its range, indicating that buying pressure hasn’t been completely exhausted. This positioning allows room for another advance without immediately triggering overbought warnings that could attract selling interest.

MACD continues to trade above its signal line, though the histogram bars have shown some compression recently. This development suggests that while the bullish trend remains intact, momentum may be moderating slightly, which would be consistent with a healthy pullback to recharge for the next advance.

The overall technical picture for remains constructive, with the sustained uptrend providing a solid foundation for continued gains, especially given the latest news on Tron’s strategic USDT mint.