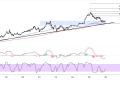

Binance Coin (BNB/USD) has successfully breached its descending trendline resistance but is now encountering difficulty in maintaining the bullish momentum that initially drove the breakout.

Trading at $650.00, the cryptocurrency appears to be entering a consolidation phase following its impressive rally from the $601.03 lows, with the recent upside lacking the conviction needed to establish a sustained advance beyond the breakout zone.

The post-breakout price action suggests that while Binance Coin managed to overcome the technical hurdle of the descending trendline, institutional follow-through has been limited. This scenario is not uncommon in cryptocurrency markets, where initial breakouts often require multiple attempts and retests before gaining sustainable traction.

Binance Coin Consolidation

The descending trendline breakout that initially sparked optimism among Binance Coin bulls has failed to generate the explosive upside momentum typically associated with significant technical breakthroughs. Instead of accelerating higher, price action has stalled near the $650 level, suggesting that sellers have regrouped to challenge the breakout’s validity.

This post-breakout hesitation often occurs when breakouts are driven more by technical positioning than fundamental demand shifts. The lack of substantial volume expansion during the initial breakout phase has left the move vulnerable to profit-taking and short-covering reversals, which appear to be materializing as the cryptocurrency struggles to maintain its gains.

However, the fact that Binance Coin price has not immediately collapsed back below the trendline indicates that some underlying demand remains intact. This suggests that the breakout may simply be undergoing a natural consolidation phase before the next directional move unfolds.

Fibonacci Correction Zones

Despite the post-breakout struggles, Binance Coin’s technical outlook remains constructive as long as key Fibonacci retracement levels continue to provide support. The 38.2% retracement at $638.16 represents the first line of defense for any corrective pullback, offering bulls an opportunity to establish defensive positions.

The 50% Fibonacci level at $631.07 emerges as a particularly significant support zone, given its psychological importance and historical tendency to attract institutional accumulation. The deeper 61.8% retracement at $625.98 serves as the ultimate support test for the breakout scenario.

Moving averages are beginning to align more favorably, with shorter-term indicators starting to slope upward and potentially preparing for bullish crossovers. The reclaim of these dynamic support levels during the recent bounce suggests that the technical backdrop is gradually improving.

The stochastic oscillator, having recovered from deeply oversold conditions, retains room for additional upside before reaching overbought extremes. This momentum cushion could provide support for any renewed bullish attempts, particularly if buyers emerge at the key Fibonacci levels.

MACD readings, while still negative, are showing signs of bottoming formation that could precede a bullish Binance Coin momentum shift. The narrowing of negative histogram readings suggests that selling pressure is diminishing, creating conditions for a potential momentum reversal if fundamental catalysts emerge.