Summary

- 404,448 Bitcoins moved to permanent holder addresses in an accumulation phase.

- Within a year, entities could announce acquiring BTC in Q3 2024.

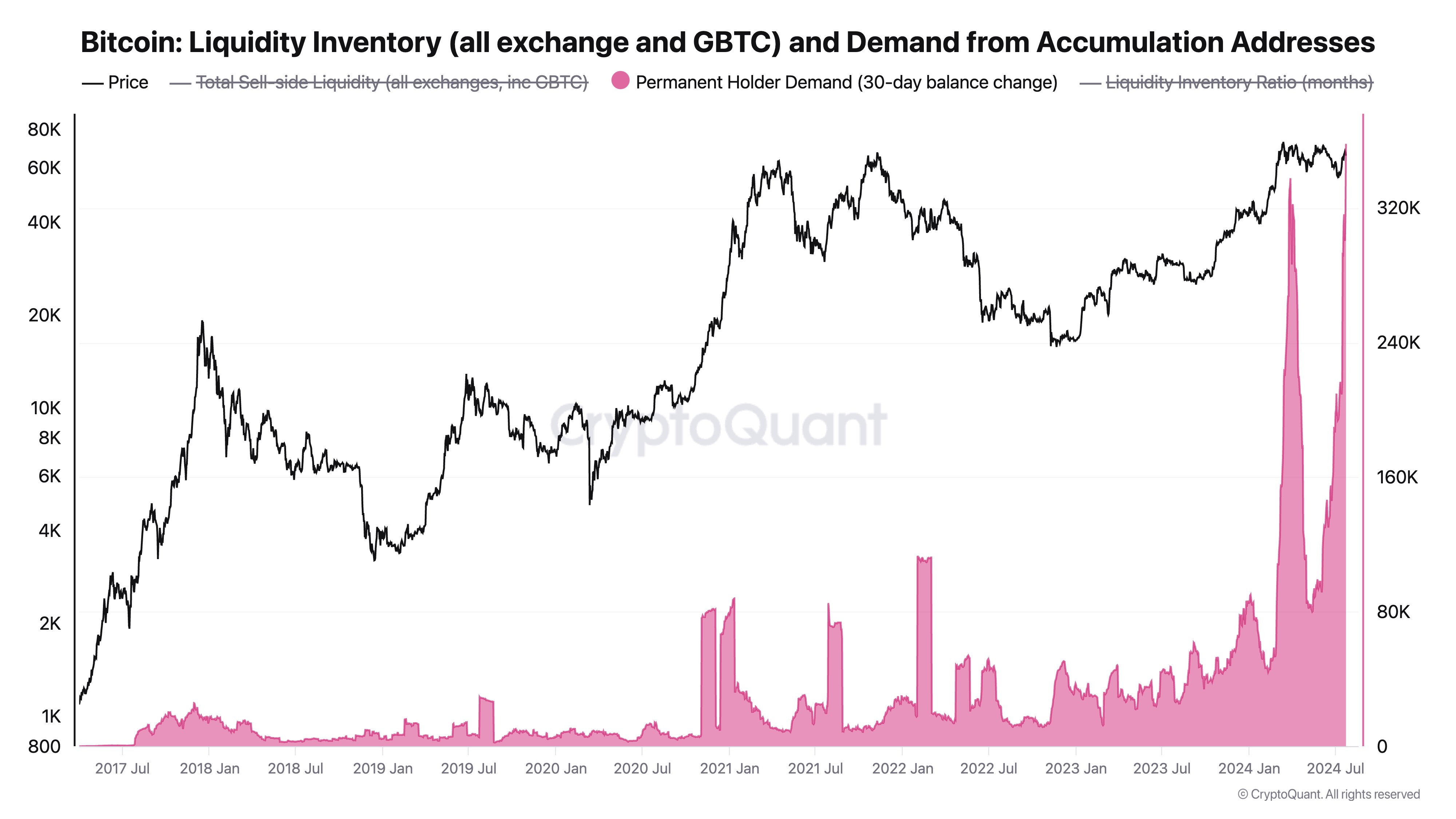

According to the latest reports of the founder and CEO of CryptoQuant, Ki Young Ju, 404,448 Bitcoins worth about $23 billion at current prices have moved to permanent holder addresses in a massive accumulation phase.

In a recent post on X, he explained that something is clearly happening behind the scenes and we’ll probably know who these entities are in about a year.

Permanent Holding Entities Gobbling Up BTC

Ki Young Ju continued and said that probably within a year or so, some significant entities that might turn out to be TradFi institutions, companies, governments, or others, will announce that they have acquired Bitcoin in Q3 2024.

He explained that after that, retail investors will regret not buying BTC due to worries about multiple factors including the German government selling its coins, Mt. Gox moves, or other macroeconomic factors.

On July 24, CryptoQuant’s CEO announced that Bitcoin was in an accumulation phase as well.

In a post on X, he said that over the past month, 358,000 BTC were moved to permanent holder addresses, highlighting that in July, global spot ETF inflows were 53,000 BTC.

Though not all remaining BTC was in custody wallets at the time, whales were definitely accumulating, and the accumulation was at an unprecedented level.

Speaking of huge entities accumulating Bitcoin, the other day, we reported that BlackRock did not sell any of its Bitcoin from its holdings on August 5 during the global market crash.

SoSoValue data noted that IBIT, BlackRock’s BTC ETF had $18.2 billion in total net assets as of August 5. Also, its trading volume surpassed $1.55 billion in the first trading hour the other day.

Data from CryptoQuant also revealed that not one single BTC left BlackRock’s wallet on that day, despite the dip and market declines.