Top Features Every Crypto Derivatives Trader Should Look For in a Platform

The cryptocurrency market is booming and has been booming for a while, with India surprisingly as the global leader in crypto adoption, with over 90 million users as of 2024. This surprising growth is driven by a tech-savvy, mobile-first population and increasing interest in alternative investment avenues. These numbers will likely reach around 330 million by 2028.

The country’s crypto derivatives market has significantly evolved over the past few years, fueled by traders who seek better options to hedge risks, improve strategies, and optimize profits in the volatile market.

In such a dynamic landscape, selecting a reliable trading platform is important for your long-term financial success. Among the several crypto exchange platforms crowding in the country, Delta Exchange stands out as fairly unique. With features catered for both beginners and experts – something many exchanges don’t provide, Delta is well-positioned to meet the needs of India’s crypto community.

In this post, let’s see some of the features you should look for when selecting a crypto exchange platform for efficient crypto trading.

Choosing a Crypto Derivatives Trading Platform: Key Features to Consider

To navigate the volatile crypto market, you need to rely on a secure, regulated platform, one that checks all the boxes for hassle-free trades. In that context, here are some key features to remember before trading in crypto futures and options:

-

Regulatory compliance

Choosing a trading platform that prioritizes regulation is important for protecting your funds and ensuring market stability. Under FIU (Financial Intelligence Unit) registration, platforms like Delta Exchange follow strict compliance protocols to safeguard your assets, prevent fraud, and maintain transparency. This means, as a trader, you can focus on strategy without worrying about security lapses or unexpected shutdowns.

Measures like cold wallet storage, two-factor authentication (2FA), and encryption strengthen this crypto exchange platform further.

-

INR-compatible trading

For Indian traders, having INR trading support can simplify transactions and reduce forex conversion fees. Delta Exchange allows you to deposit, trade, and withdraw in INR, making the process faster and more cost-effective. This feature bypasses the currency conversion hassle and aligns perfectly with the needs of a growing crypto-savvy population in India.

-

Cautious and risk-free trading

If you’re just starting out, financial risk is a big concern. Before exploring the market fully, look for crypto exchange platforms that offer demo accounts before investing real money. You can rely on Delta Exchange’s demo account to test strategies and learn the basics without putting real money on the line. This is the perfect way to build your confidence.

-

High leverage and hedging

Always look for crypto exchange platforms that offer good leverage, stop-loss orders, and hedging options to maximize your profits. For example, Delta offers a balanced approach to trading, with 100x leverage on crypto derivatives contracts.

If you invest 1,000 to trade ETH on Delta using 100x leverage, you can control 1 lakh worth of ETH (1,000 X 100). If the ETH price rises, your initial investment doubles. Also note that it also carries a high loss risk if the asset price drops.

-

Affordable entry price

If you’re new to the market, cost can often feel like a barrier. Lower, affordable prices allow traders of all budgets to participate, making the crypto exchange platform accessible to both beginners and experienced traders.

For such a seamless experience, you can turn to the Delta Exchange platform, which offers small lot sizes, like BTC contracts at around ₹5,000 and ETH contracts at around ₹2,500.

-

Advanced trading tools

When choosing a crypto derivatives trading platform, it’s important to have access to advanced tools that can help you refine your strategies, reduce risks, and optimize your returns. Features like trading bots can automate and execute trades 24/7, reducing errors and emotional bias. Tools like deep OTM/ITM contracts are great for capturing significant price movements with daily and weekly expiries.

Delta Exchange covers all these bases, enhancing your overall crypto futures and option trading experience. It also offers basket orders for multiple trade executions with margin benefits.

-

Versatile product suite

A versatile product suite is essential for diversifying your crypto portfolio, optimizing strategies, and managing risk effectively. It allows you to switch between short-term speculation and long-term positioning without changing crypto exchange platforms.

Delta Exchange offers this flexibility with a wide range of products, including futures, perpetual swaps, and options contracts for Bitcoin (BTC), Ethereum (ETH), Solana (SOL), Avalanche (AVAX), and many other altcoins. These contracts have daily, weekly, and monthly expiries to match your investment goals.

-

Customer support

Even with the most advanced features and seamless trading experience on the crypto exchange platform, issues can still arise – whether it’s a technical glitch, trade query, or account concern. That’s why having reliable, 24/7 customer support is important.

Delta Exchange offers round-the-clock assistance – you can submit a ticket for your queries and get all the timely support you need.

Final Thoughts

Choosing the right crypto derivatives platform can make a huge difference to your trading success. It’s not just about features, but also about safety, innovative tools, and reliable support. If you’re ready to explore the crypto futures and options market, Delta Exchange might be a great place to start.

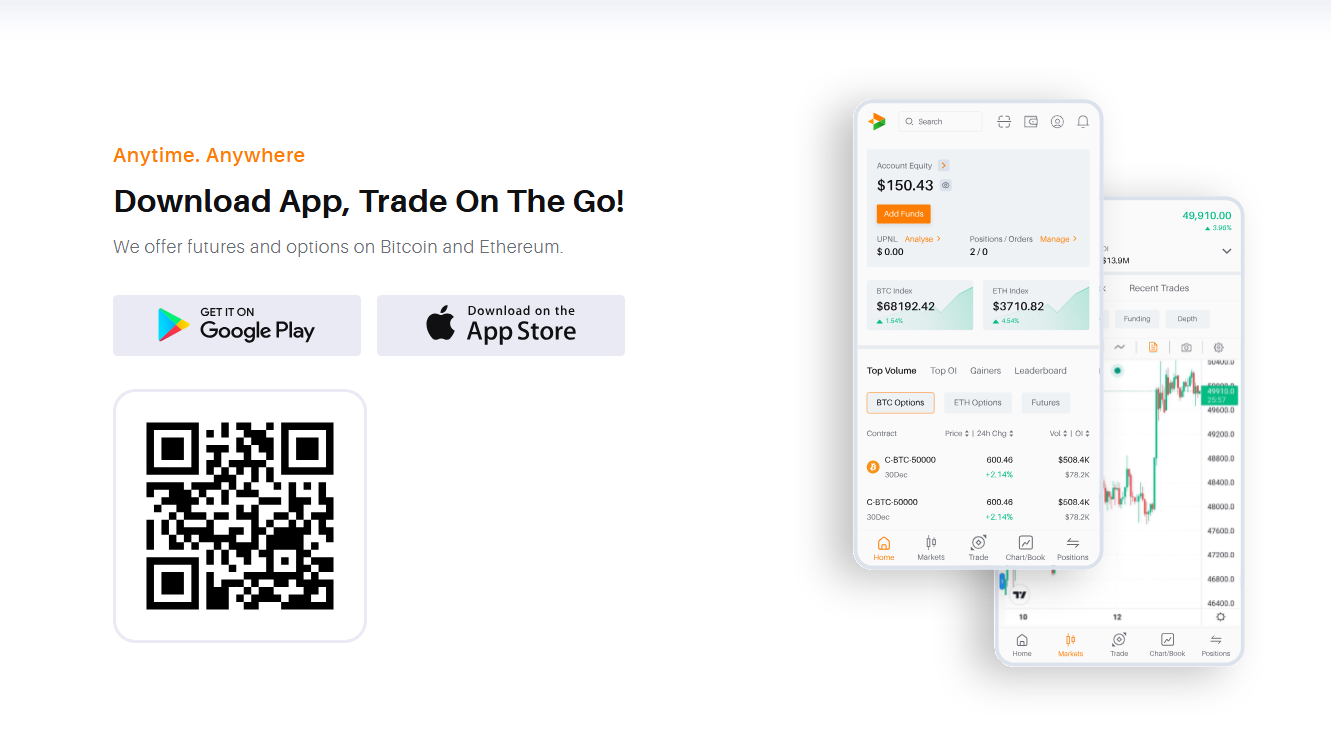

Source | Download the Delta Exchange app on an Android or iOS device

You can visit the website at www.delta.exchange, sign up, deposit funds in INR, and explore their range of products. You can also download the Delta Exchange app for trading crypto derivatives on the go.

For more information, visit the website or join our community on X.

Disclaimer: Crypto trading carries inherent risks due to its high volatility. This article is for informational purposes only. Kindly do your own research and consult the experts before making any investment decisions.

![[TEAMZ Summit 2026] Title & Gold Sponsorships Sold Out. Only 1 Platinum Slot and 3 Silver Slots Remaining — Final Sponsor Recruitment Begins for Japan’s Largest Web3/AI Conference](https://www.btcnews.com/wp-content/uploads/2026/02/Picture1.png?w=120&h=86&crop=1)