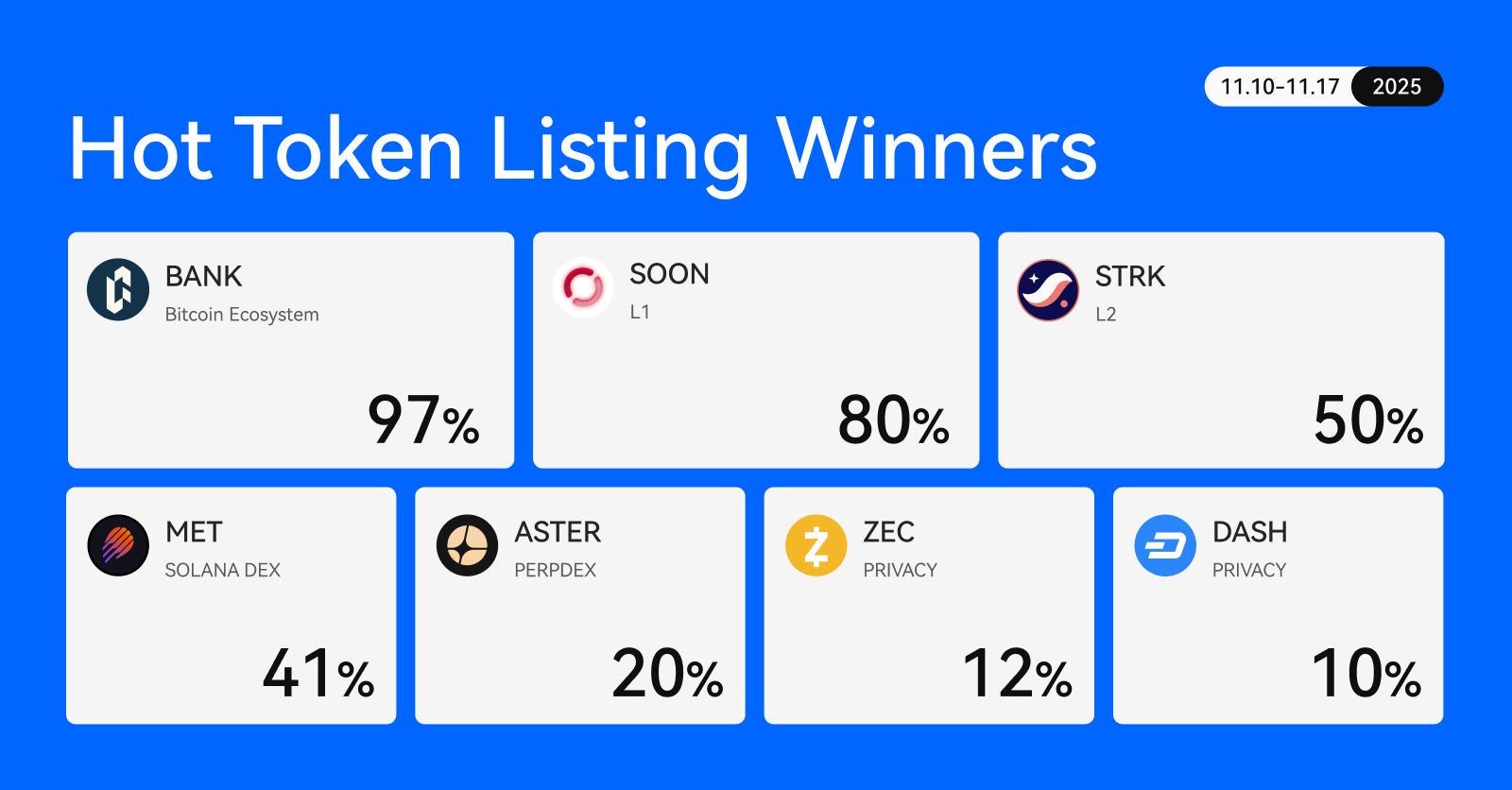

Last week, the crypto market displayed a clear divergence between overall macro sentiment and sector-specific rotation. While BTC traded sideways, locked in a stalemate between bulls and bears around a key range, investors actively focused on structural opportunities within the Bitcoin ecosystem, Solana DEXs, and the L1/L2 scaling sectors. HTX data from November 10 to 17 show that high-quality assets across multiple sectors performed exceptionally, highlighted by BANK’s remarkable 97% surge in a single week.

Bitcoin Ecosystem: BANK Leads With a 97% Weekly Gain

The Bitcoin ecosystem was clearly in the spotlight this week. Momentum in the sector continued to build in the fourth quarter, driven both by the strengthening BTC Layer 2 narrative and active support for ecosystem assets from major centralized exchanges (CEXs). BANK’s exceptional performance also reflects the market’s strong conviction in the “next major breakout within the Bitcoin sector.”

- BANK (Lorenzo Protocol): A modular Bitcoin L2 infrastructure built on Babylon. First launched on HTX in May, BANK surged 97% this week, fueled by community enthusiasm and an upgraded ecosystem narrative, securing its position as the top gainer of the week.

L1/L2 Sector: SOON and STRK Rise as Funds Return

The L1 public chain and Layer 2 sectors regained investor attention this week, leading to a general uptick in trading activity. Investor sentiment shifted toward “high-growth narratives and high-elasticity assets”. Compared to volatile meme coins or one-off spike tokens, the L1/L2 sectors showed a clear move toward a more sustainable growth trajectory.

- SOON: Up 80% for the week. Progress in ecosystem rollout and performance enhancements fueled renewed short-term interest, making SOON the top L1 performer of the week.

- STRK (StarkNet): Gained 50% this week and stands out as the most representative growth asset in the L2 sector.

DEX Sector: Solana Remains in Focus, PerpDEXs Reclaim Attention

DeFi capital efficiency is on the rise, turning the derivatives market into a key hub for high-frequency on-chain traders and boosting valuations of related PerpDEX projects. At the same time, the Solana ecosystem remains one of the most closely watched narratives in Q4, with strong on-chain TVL, DEX trading volume, and active user numbers sustaining robust ecosystem liquidity.

- MET (Meteora): Up 41% this week. Meteora is a dynamic liquidity pool protocol on Solana that supports Automated Market Makers and token trading through its Dynamic Liquidity Management Mechanism (DLMM). This week’s gain reflects continued native ecosystem value discovery.

- ASTER (Aster): Rose 20% this week, a standout performer in decentralized perpetuals (PerpDEX). The PerpDEX sector is largely driven by trading volume and market volatility.

Privacy Sector: ZEC and DASH Post Solid Gains

Privacy-focused assets often act as a risk-off hedge during periods of market volatility. With signs of regional regulatory stabilization, the sector is attracting renewed interest. The strong performance of ZEC and DASH underscores investor confidence in secure, forward-looking assets.

- ZEC (Zcash): Up 12% for the week. As one of the pioneering privacy tokens, ZEC is built on zero-knowledge proof (zk-SNARKs) technology and continues to provide foundational support for on-chain privacy protection.

- DASH (Dash): Gained 10% this week. Known for its “hybrid privacy + instant payment” model, DASH holds distinct advantages in payment network restructuring and on-chain settlements.

Limited-Time Offer: Random Airdrop #4 Now Live

HTX has launched the 4th phase of its limited-time random airdrop event, giving spot trading users extra rewards as high-quality assets rotate. The designated cryptos (Spot USDT trading pairs) are: XRP, ZEC, TRUMP, WLFI, MET, BANK, ZK, MELANIA, and DASH. To participate, simply click “Register Now” on the event page.

Quality New Assets Drive Continuous Structural Trends

The latest HTX Hot Listings Weekly Recap confirms that the crypto market is entering a period of “multi-sector synchronization and fast-paced value rotation”. The breakout of the privacy-focused asset ecosystem, the rebound of PerpDEX, and market attention on specific narratives are collectively driving sector rotation.

HTX will continue to filter and select high-quality sector assets, providing users with projects that offer stronger growth potential.

About HTX

Founded in 2013, HTX (formerly Huobi) has evolved from a virtual asset exchange into a comprehensive ecosystem of blockchain businesses that span digital asset trading, financial derivatives, research, investments, incubation, and other businesses.

As a world-leading gateway to Web3, HTX harbors global capabilities that enable it to provide users with safe and reliable services. Adhering to the growth strategy of “Global Expansion, Thriving Ecosystem, Wealth Effect, Security & Compliance,” HTX is dedicated to providing quality services and values to virtual asset enthusiasts worldwide.

To learn more about HTX, please visit https://www.htx.com/ or HTX Square , and follow HTX on X, Telegram, and Discord. For further inquiries, please contact glo-media@htx-inc.com.