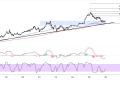

Binance Coin (BNB/USD) has entered a corrective phase after reaching the significant milestone of $860.8, with the cryptocurrency currently pulling back to test key support levels that could determine whether the impressive uptrend continues or faces deeper retracement.

The recent decline has brought Binance Coin to the area of interest where the ascending trend line converges with important Fibonacci retracement levels, creating a possible setup for potential buyers looking to enter the market.

Trading around $827.9, Binance Coin is currently testing the 38.2% Fibonacci retracement level at $819.8, which represents the first major support zone following the pullback from recent highs. This level coincides with an area of previous resistance that could now act as support, suggesting that institutional and retail interest may emerge at these price levels to defend the broader uptrend.

The longer-term ascending trend line that has guided Binance Coin’s impressive rally throughout this appears to be converging with the current price action. This trend line has proven to be a reliable source of support during previous corrections, and its intersection with the Fibonacci levels creates a confluence zone that often attracts significant buying interest from trend-following traders.

Uprend Remains Intact

The moving average structure continues to paint a constructive picture for Binance Coin, with the key averages maintaining their upward trajectory despite the recent pullback. The price action suggests that Binance Coin is simply undergoing a healthy correction within the context of the broader uptrend, rather than signaling a more significant reversal.

The positioning of the moving averages provides multiple layers of dynamic support should the current Fibonacci levels fail to hold. This safety net effect often gives buyers confidence to step in at these technical levels, knowing that additional support exists at lower levels if needed.

The gap between the shorter and longer-term moving averages remains wide, indicating that the underlying momentum remains strong despite the recent consolidation. This technical configuration typically suggests that any pullback is likely to be temporary in nature, with the trend eventually reasserting itself once the correction runs its course.

Oversold Bounce Incoming

The MACD indicator shows signs of momentum deceleration following the recent decline, but the overall structure remains above the zero line, indicating that the bullish bias has not been compromised. The histogram appears to be forming a base, suggesting that selling pressure may be beginning to wane and setting the stage for a potential momentum reversal.

Stochastic readings have moved into oversold territory during this pullback, indicating that the recent selling may have been overdone in the near term. This oversold condition often precedes bounce attempts, particularly when combined with strong support levels and trend line confluence.

Should the current support zone around $819.8 hold firm, Binance Coin could target a recovery back toward the 50% retracement at $807.2 initially, before potentially challenging the recent highs at $860.8. A successful defense of these levels would reinforce the bullish narrative and could pave the way for new all-time highs above the current resistance zone.