Summary

- Bitcoin recorded a significant surge yesterday, pushed upwards by the FOMC meeting.

- US Fed said that economic activity continued to expand at a solid pace.

Yesterday, Bitcoin saw a price surge, hitting $87,000, following the FOMC meeting in the US. The Fed left interest rates unchanged but said that the quantitative tightening will start ending on April 1st.

Bitcoin Trades Above $85,000

At the moment of writing this article, BTC is trading above $85,000, up by over 3% in the past 24 hours.

Yesterday, Bitcoin’s price recorded a surge from $83,000 levels, reaching prices above $87,000. The main catalyst was the FOMC meeting which showed optimistic results for the US economy.

US Fed Will Start Ending QT Next Month

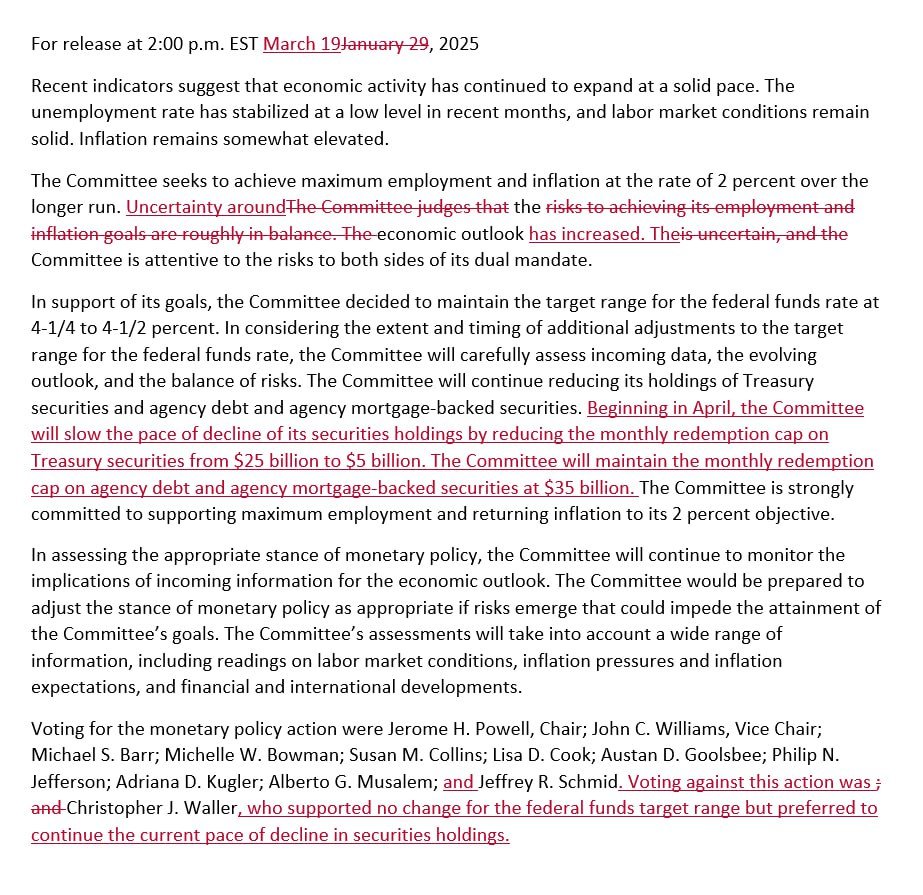

The Fed decided to leave the interest rates unchanged at 4,25-4,50% but also said that the quantitative tightening will start ending on April 1st.

In a note released before Jerome Powell’s speech, the Fed stated that recent indicators suggest that economic activity has continued to expand in the US at a solid pace.

The notes revealed that the unemployment rate has stabilized at a low level in recent months, and labor market conditions remain solid. At the same time, inflation remained elevated, which led the Fed to leave the rates unchanged.

The Committee said that their inflation target remains at the rate of 2%, and in considering the extent and timing of additional adjustments to the target range for the federal funds rate, they will carefully assess:

- Incoming data

- The evolving outlook

- The balance of risks

The notes also revealed that the Committee will continue reducing its holdings of Treasury and agency debt, together with mortgage-backed securities.

Beginning in April, they will slow the pace of decline of its securities by reducing the monthly redemption cap on Treasury securities from $25 billion to $5 billion.

The beginning of an end for the QT translates into a US liquidity rebound which will allow more capital to flow into Bitcoin and the crypto market pushing prices higher, despite the previous mixed views from analysts.

The next FOMC meeting is scheduled for May 7.

The Fed’s decisions, together with Trump’s supporting policies for the industry translate into optimistic views for the future.