Summary

- Bitcoin’s price broke the important level of $68,000 a few hours ago.

- BTC Markets analyst believes that the US BTC ETFs contributed to the price rally.

Bitcoin’s rally continued over the weekend, and the coin reached prices over the important level of $68,000. At the moment of writing this article, BTC is trading above $67,000, up by more than 1% in the past 24 hours.

The coin broke the $68,000 resistance line during Sunday night trading in Eastern Standard Time.

Substantial Inflows in BTC ETFs as Price Trigger

According to a crypto analyst of BTC Markets, Rachael Lucas, one of the main price triggers for Bitcoin’s current momentum is the substantial inflows into the US-based Bitcoin ETFs.

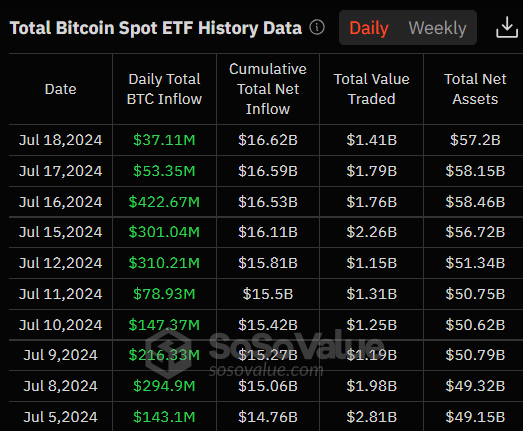

BTC ETFs recorded their 11th consecutive day of inflows on July 19, when the crypto products saw an influx of $383.6 million, according to SoSoValue data.

The total net assets in the crypto products are $60.7 billion as of last Friday.

The same reports reveal that BlackRock’s Bitcoin ETF has accumulated almost $19 billion in net inflows since the crypto products’ inception.

Lucas also highlighted that in total, the market has witnessed record net inflows that exceeded $17 billion, reflecting heightened institutional interest and confidence in Bitcoin as an asset class.

Other Factors Affecting the Market

The crypto market also anticipates the launch of the first batch of spot Ethereum ETFs in the US this Tuesday, July 23.

Lucas also said that the exhaustion of large sellers, especially the German Government’s massive sell-off of 50,000 BTC also contributed to Bitcoin’s price surge. The completion of this sale reportedly generated around $2.87 billion and has removed a significant chunk of BTC from the market, reducing selling pressure.

The market’s trajectory could be affected by the pending repayments from the Mt. Gox crypto exchange. The repayments totaling around $9 billion are expected to be processed by early August, according to Lucas.

Some analysts believe that the Mt. Gox FUD is overestimated.

According to the latest reports, it seems that Bitcoin’s rally may have also been triggered by Joe Biden’s announcement that he would not run in the presidential election in November.

Biden reportedly endorsed Vice President Kamala Harris to replace him as the Democratic Party’s nominee.