Key Points

- When the Bitcoin Average Profitability Index rises above 300%, investors will likely take profits.

- BTC is currently trading above $67,000.

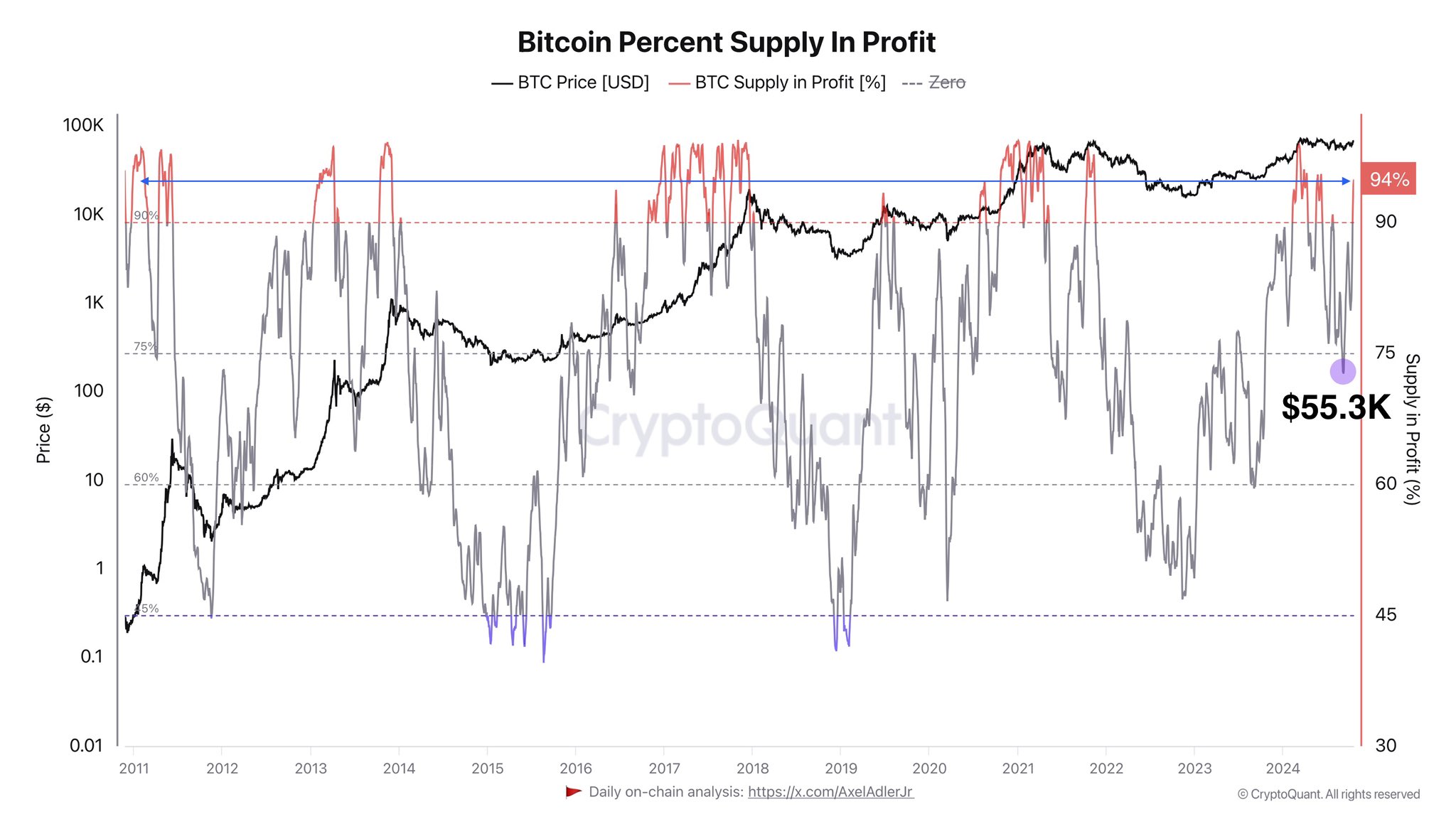

As noted earlier by CryptoQuant author Axel Adler, 94% of the Bitcoin supply is in profit, and the majority of the coins have been bought at the $55,000 level.

He shared a graph showing Bitcoin’s price in USD and the BTC supply in profit from 2011 until 2024, revaling the increase in profits over time.

The 94% profit level was recently surpassed again back in 2022 and 2021, according to his post.

He also shared a post revealing, the Bitcoin Average Profitability Index and when investors might start reaping profits.

Bitcoin Average Profitability Index

Currently, the Bitcoin Average Profitability Index is at 202% which means that the price is two times the realized price.

According to the analyst, when the index rises above 300%, investors are most likely to start taking profits actively.

The last time this Bitcoin index reached the levels mentioned above was in 2022.

Bitcoin Is Trading Above $67,000

At the moment of writing this article, BTC is trading above $67,000, following a day with increased volatility.

Earlier today, BTC’s price dipped to levels close to $66,700, following a quick rebound.

Yesterday, October 21, BTC recorded prices above $69,000 – levels that have not been seen since June ahead of today’s price drop.

Despite the intense volatility recorded by Bitcoin’s price at the beginning of this week, interest in Bitcoin ETFs continues.

Yesterday, the crypto products recorded their 7th consecutive day of inflows at over $294 million.

BlackRock’s Bitcoin ETF, IBIT, and Fidelity’s Bitcoin ETF, FBTC, were the only ETFs that recorded influxes, at $329 million and $5.9 million respectively, according to SoSoValue data.

Bitcoin Potential Price Catalysts

Bitcoin’s price rally from last week has been strongly supported by the rising odds of a Trump presidency, as analysts at Bernstein recently noted.

They addressed a correlation between the rising Trump chances and the price rally recorded by Bitcoin in October.

The same factor along with continued inflows in US BTC ETFs could continue to pump the price during the next few days, along with other important economic events taking place this week.

Today, Polymarket data shows that Trump continues to lead Kamala Harris with 64.4% to 35.4%.